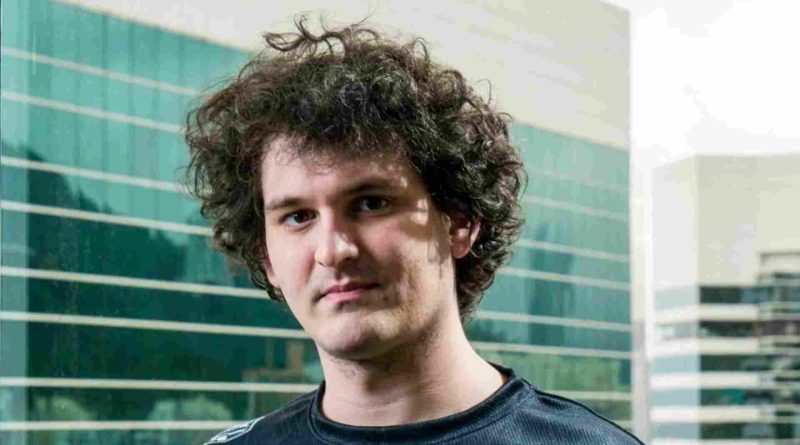

Unraveling the Saga of Sam Bankman-Fried: A Tale of Deception and Delusion

At the core of Sam Bankman-Fried’s downfall lies the intricate relationship between FTX and Alameda.

Long before the truth about Sam Bankman-Fried emerged, signaling the beginning of a catastrophic sequence of events – panic, investigations, and ultimately, a devastating collapse – whispers of impending doom circulated within his labyrinthine crypto domain.

Within FTX, the exchange that had elevated his initials to the status of a new era’s emblem of prosperity and influence, one question echoed persistently: Where is SBF?

According to current and former employees, Bankman-Fried seemed to have vanished. Then, abruptly, a department nearly missed its October payroll without explanation. Something was amiss.

The extent of the calamity is now glaringly apparent. Following one of the most tumultuous weeks in the nascent, unregulated realm of cryptocurrencies, his digital asset empire – encompassing over 130 entities – plummeted into bankruptcy.

The scandal has rattled the crypto community, which once lauded Bankman-Fried as the J.P. Morgan of their era, leaving them grappling for comparisons.

Is this reminiscent of crypto’s Lehman Brothers, a narrative of unchecked risk-taking? Or does it delve into darker territory, akin to an Enron-esque debacle exposing corruption and malpractice? Federal authorities are delving into precisely that inquiry.

As Chapter 11 filings flooded in on Friday morning, myriad questions emerged, foremost among them: Will the over 1 million FTX customers ever recoup their investments? Some astute traders sensed trouble brewing long before the storm hit and made their exits preemptively. Esteemed figures in Silicon Valley who embraced Bankman-Fried are now poised to endure significant losses.

While much of the broader narrative is now widely disseminated, deeper insights reveal a bleaker reality than previously acknowledged. Bankman-Fried, with his perpetually unkempt appearance, tube socks, and philanthropic pledges, had hoodwinked venture capital luminaries, politicians, and media figures alike.

And perhaps, along the way, he had deluded himself as well.

Intertwined Bonds

Approximately two months prior to his downfall, Bankman-Fried grappled with a seemingly innocuous question: Where does he reside?

“I, um, so, sorry, I – I’m hesitating because I mostly sleep on a bag,” he disclosed during a Zoom session with reporters, alluding to his beanbag chair. Bankman-Fried, it was known, shared a residence in the Bahamas with housemates, including leaders from Alameda.

Unbeknownst at the time: the scant demarcation between the two entities. Reports have surfaced of Bankman-Fried’s romantic involvement with Caroline Ellison, Alameda’s CEO, a detail previously undisclosed.

The nexus between FTX and Alameda stands at the crux of Bankman-Fried’s downfall. The U.S. Securities and Exchange Commission is scrutinizing the extent of interconnection between his ventures and whether FTX mishandled client funds.

While the two entities served distinct functions – FTX for trading and Alameda for crypto investment – their financial entanglement posed inherent risks, a departure from conventional market regulations absent in the crypto sphere.

Some insiders were privy to the intricate financial interplay between the two firms. One individual, who secured funding from Alameda Ventures, disclosed receiving funds from FTX instead.

Ultimately, apprehensions surrounding Alameda catalyzed Bankman-Fried’s empire’s unraveling.

Reports surfaced of Alameda’s indebtedness to FTX via FTT tokens, unsettling investors by week’s end. Panic reached a crescendo when Binance CEO Zhao announced the liquidation of its FTT holdings, valued at over $500 million.

Zhao’s offer to assume control of FTX on Tuesday disintegrated almost as swiftly as it materialized.

“The issues transcend our capacity or ability to offer assistance,” declared Binance on Wednesday.

Zhao lamented, adding a tearful emoji.

Forewarnings

Though FTX’s tribulations surfaced in recent days, Bankman-Fried’s conduct had raised concerns among subordinates for weeks.

Within FTX, Bankman-Fried had been conspicuously absent from senior staff for at least a month, insiders reveal. One department encountered payroll difficulties weeks earlier, with scant elucidation on the matter.

This wasn’t an isolated incident. Payment issues arose as early as spring, coinciding with turbulence in various crypto ventures and investors, including TerraUSD, Three Arrows Capital, and Celsius.

Despite mounting crises, the company persisted in remunerating employees with FTX equity, now virtually worthless.

Sensing impending liquidity strains, astute investors and hedge fund traders initiated massive fund withdrawals from FTX. A glaring indicator: withdrawal transactions, typically instantaneous, now languished for hours, sparking concerns of underlying instability.

Nevertheless, major stakeholders were blindsided. Many learned of FTX’s plight only upon Binance’s rescue offer.

Even amidst FTX’s tussle with Binance, some optimists clung to hope for FTX’s revival, unwilling to part with their shares in secondary markets, as revealed in documents reviewed by Bloomberg.

Optimism Wanes

However, hope swiftly dissipated as the FTT token plummeted by 80% within 24 hours, prompting VC firms to tally losses. Sequoia Capital, a prominent FTX backer, relegated its stake to nil, baring its losses on Twitter.

Amid internal chaos at FTX, employees contended with a disquieting revelation: the balance sheet they had reviewed evinced no liquidity woes, raising suspicions of parallel accounting.

Bankman-Fried epitomized two fundamental principles of the crypto sphere – transparency and decentralization. Yet, beneath the veneer of tweets and assurances regarding FTX’s solvency, doubts festered within the organization.

“A cult of personality surrounded Sam Bankman-Fried, portraying him as a visionary, a once-in-a-lifetime intellect,” observed Molly White, a software engineer and author of “Web3 is Going Just Great,” chronicling crypto-world narratives.

“People often attribute genius to those merely affluent, and I suspect that was somewhat the case here,” she reflected.

Hunting for Funds

As the fate of his imperiled empire hung in the balance, the whereabouts of SBF, amidst its collapse, came into focus.

Bankman-Fried embarked on a frantic quest to secure capital in late October, engaging with Saudi Arabia’s sovereign wealth fund and Abu Dhabi’s Mubadala Investment Co., insiders reveal. Representatives from PIF and Mubadala declined to comment.

Anthony Scaramucci, who sold a portion of SkyBridge Capital to FTX Ventures, aided in fundraising efforts.

“We were endeavoring to assist him in fundraising. He had acquired 30% of my business, and as responsible stakeholders, we endeavored to facilitate his endeavors globally,” he elucidated in a CNBC interview on Friday.

However, negotiations floundered as FTX’s implosion accelerated.

Meanwhile, with the CEO absent, employees pursued avenues to generate cash.

Assets were up for grabs: FTX US Derivatives, a pioneering trading platform, clearing firm Embed, and even the naming rights to the Miami Heat’s arena. Voyager, salv

aged from insolvency by Bankman-Fried, sought investors to repurchase the company, sources disclosed.

Nevertheless, potential buyers balked at the risk, particularly with bankruptcy looming, prompting several to withdraw from negotiations.

Leadership Void

If Bankman-Fried appeared out of depth amid the crypto industry’s precarious trajectory earlier this year, he concealed it well. However, the departures of two key figures from Alameda and FTX.US earlier in the summer elicited scrutiny.

Bankman-Fried, who helmed both Alameda and FTX until 2021, ceded control to Ellison and Sam Trabucco as co-heads in October 2021.

Trabucco’s departure in August under vague circumstances, coupled with his disclosure of reducing his role for months, hinted at a hasty exit shortly after assuming the position. He remained uncertain about his future plans but disclosed his acquisition of a boat.

Brett Harrison, head of FTX.US, followed suit, departing without divulging his next move.

By Thursday evening, with dwindling support, Bankman-Fried resigned as FTX Group’s CEO after plunging his empire into bankruptcy. Valued at an estimated $15.6 billion at the week’s onset, his assets now languish at zero, according to the Bloomberg Billionaires Index. Charitable endeavors banking on his largesse face uncertainty.

Regulatory intervention, long evaded by the crypto sector, looms imminent. Congressional leaders contemplate issuing subpoenas, sources reveal.

“Lots of parallels have been drawn to Lehman. I’d liken it to Enron,” remarked former Treasury Secretary Lawrence Summers in a Bloomberg TV interview. “The brightest minds in the room. Not merely financial miscalculations, but – according to reports – hints of deceit.”

John J. Ray III, appointed to succeed Bankman-Fried, boasts expertise in turnarounds and restructurings, having held senior positions in bankruptcies, including Enron’s.

Amidst the turmoil, approximately 1 million customers remain in limbo, pondering the likelihood of recovering their investments from the tousled-haired wunderkind they entrusted to guide them into a new financial frontier. The revelation that investors and employees alike fell prey to deception offers scant solace.

Yet, amidst the wreckage, a handful of steadfast believers continue to back Bankman-Fried.

On Polymarket, a crypto prediction platform, users wager on the question “Will SBF face federal indictment by year-end?” Odds suggest an 80% chance of exoneration.

In contrast, optimism appears scarce within the Miami offices of Bankman-Fried’s U.S. exchange. By Thursday, FTX.US’s office door bore no signage, emblematic of the tumult engulfing the once-heralded entity.