The Global Minimum Tax Initiative: A Step Towards Fair Corporate Taxation

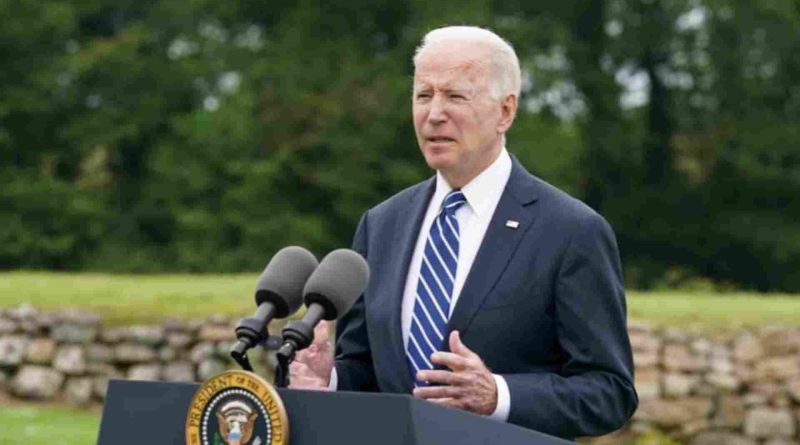

In a significant move, President Biden and leaders of the G-7 nations are set to endorse a global minimum corporate tax rate of 15% or more. This initiative marks a tangible step forward for the Biden administration in its pursuit of a foreign policy geared towards the middle class.

During his visit to St. Ives in Cornwall, Britain, President Joe Biden reiterated his administration’s commitment to donate 500 million doses of the Pfizer coronavirus vaccine to the world’s most impoverished countries.

The endorsement of the global minimum corporate tax, scheduled for Friday, is part of a broader agreement aimed at modernizing international tax laws to accommodate the challenges posed by a globalized, digital economy.

Additionally, the leaders will unveil a plan to replace Digital Services Taxes, previously targeting major American tech companies, with a new tax structure linked to the actual business operations of multinational corporations rather than their headquarters’ locations.

For the Biden administration, the Global Minimum Tax represents a tangible stride towards its objective of formulating a foreign policy that prioritizes the interests of the middle class over those of billionaires and multinational corporations.

This strategy seeks to ensure that globalization and trade benefit ordinary working Americans, rather than solely catering to the elite.

On a global scale, the Global Minimum Tax aims to put an end to the tax competition among countries, which has led some nations to drastically reduce their corporate tax rates to attract multinational corporations.

If widely implemented, the Global Minimum Tax would effectively discourage global corporations from relocating their headquarters to low-tax jurisdictions such as Ireland and the British Virgin Islands, even though their operations and customer base are elsewhere.

In addition to the endorsement of the Global Minimum Tax, President Biden and G-7 leaders are contemplating a plan to expand the International Monetary Fund’s provision of Special Drawing Rights to low-income nations. This initiative is intended to enhance international development financing for impoverished countries, enabling them to procure Covid vaccines and expedite their recovery from the pandemic’s aftermath.

Furthermore, the G-7 leaders pledge to sustain policy support for the global economy until a robust, balanced, and inclusive economic recovery is achieved.

However, it is the Global Minimum Tax proposal that holds the most significant potential to impact corporate finances and shape investor decisions.

A senior administration official remarked that the G-7 tax accord will lay the groundwork for broader consensus at the G-20 summit.

A joint statement by President Biden and British Prime Minister Boris Johnson outlines the commitment to an equitable distribution of taxing rights, with market countries granted taxing authority over at least 20% of profits exceeding a 10% margin for the largest multinational enterprises.

This agreement also commits to a minimum global tax rate of 15% on a country-by-country basis and the elimination of Digital Services Taxes and similar measures targeting all companies.

The removal of Digital Services Taxes, which primarily targeted major American tech firms, marks a significant victory for the United States. Analysts anticipate that this move, coupled with the implementation of a Global Minimum Tax, will instill certainty in the international tax landscape, benefiting Big Tech companies in the long term despite potential short-term cost increases.

Once endorsed by the G-7, the Global Minimum Tax proposal will seek support from G-20 nations, including China, India, Brazil, and Russia, during their upcoming meeting in Venice, Italy. Both the IMF funding initiative and the international tax plan are expected to feature prominently on the agenda.

The fate of the Global Minimum Tax plan within the G-20 remains uncertain, as some member nations maintain low corporate tax rates to attract businesses.

Nevertheless, groundwork for the adoption of a Global Minimum Tax has been laid by the OECD’s Inclusive Framework on Base Erosion and Profit Shifting (BEPS), which has garnered support from 137 member countries and jurisdictions. This framework outlines a two-pillar approach to international taxation, focusing on taxing profits based on consumer presence and implementing a global minimum corporate tax rate of at least 15%, irrespective of individual countries’ tax rates.